Tell us yes or no, and guess the number of valentines candies to win a $50 VectorVest Gift Voucher.

Two simple things you must do to enter our $50 Valentine’s Challenge:

Two simple things you must do to enter our $50 Valentine’s Challenge:

1. Post a comment below and let us know if you have a trading plan or not. This can be a simple Yes or No, or you can include the details of your plan if you wish.

2. Guess the number of valentines candies in the jar. (larger photo below)

One entry per person please. The winner will be the first one to tell us whether or not they have a trading plan AND guess the correct number of candies in the jar. If no one makes the correct guess, the prize will be awarded to the closest guess. If there is a tie for the closest guess, we will draw for the winner.

Just submit your answers to 1. and 2. above here in the Comments section or join us for Monday live SOTW Q&A webinar. We’ll ask attendees to give us their answers to 1. and 2. and then announce the winner at the end of the webinar. The free webinar runs tomorrow from 1:00 p.m. to 2:00 p.m. EST. Register for our LIVE WEEKLY WEBINAR: Here is the link to register if you haven’t already done so: http://news.vectorvest.com/SOTW_QA_MembersOnly_021615_registration.html

Remember, as long as you register for our webinars in advance you will receive an email with a link to the recording as soon as it is available, usually the same day. After that, the recording is available the next day at www.vectorvest.fr/events. Here again is that jar of Valentines candy.

In tomorrow’s Q&A, we’ll discuss the Brian D’Amico’s presentation about how to put your trading plan into action. We’ll answer your questions and review the following trading plans:

In tomorrow’s Q&A, we’ll discuss the Brian D’Amico’s presentation about how to put your trading plan into action. We’ll answer your questions and review the following trading plans:

1. All five SFS Trading Plans in the US database. How would you be doing if you started them Jan.2?

2. The model portfolios in VectorVest Canada: 1. Jake’s Patent Winners/Hindenburg 2. Retirees Income Portfolio 3. Safe and Sound/Crash Landers/CA.

3. The Trading Plans discussed in our recent Blog articles:

a. Managing Positions Using 3-EMA/8-EMA Crossovers – Nov 21 – Technical Studies Category

b. User Group Wisdom – Sharing A Trading Plan – Jan 17 – Portfolio Management

c. Markham UG’s Business Plan for a Retired Couple – Jan 20 – Retirement Planning

Why is having a trading plan so important? Brian identified the following reasons:

1. You will feel more in control of every aspect of your trading.

2. You will make decisions based on rules, not emotions.

3. You will feel more confident.

4. You will make steady gains.

5. You will label yourself a success.

Weekend Review:

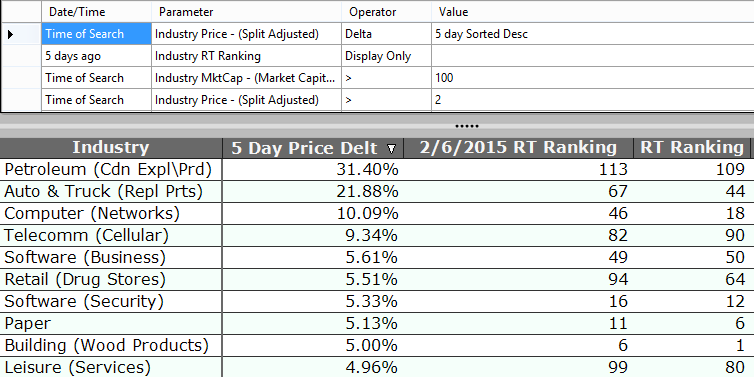

Here are the week’s top price gainers:

Here are the week’s top performing industry groups. Note: Look how well some of the top stocks in these industry groups have performed since the average price of the group crossed above its 40-day moving average. For example, in our SOTW Q&A three weeks ago and again last week we talked about Building (Wood Products) making a big move. Industry Groups that just crossed above the 40-MA this week include Aerospace & Defense (Mfrs); Banks (Domestic); and Building (Residential/Commercial).

Here is the top 5-day Buy and Hold strategy from the DERBY results. It’s Odd Fellows Long, a bottom fishing strategy that made an overall gain of 6% by finding several petroleum stocks five days ago. Autocanada made a big move as well.

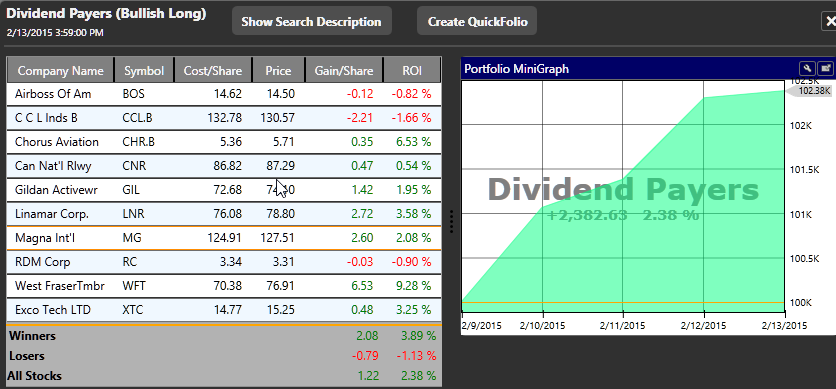

Dividend Payers from the Conservative folder was the top 5-day Buy and Hold DIVIDEND strategy found in the DERBY results:

Yes, but don’t always follow it. 780 candies.

1. Yes, and trying harder in 2015 to follow it

2. 167 candies

I have a couple of trading plans. One using the 3 and 8 crossover developed by Petra and one that pertains to options. Both working well.

650 candies in the jar.

Yes but it is difficult to respect. 980 candies.

Yup- I have a trading plan which I refined at the Trafing as a Business Seminar and have now included Pertas 3/8 crossover which Im experimenting with and really like.

Im guessing 285 candies

Happy Family Day

Heather

I am using EMA 8-34 daily chart with Macd .

699 candies.

No.

250 candies

No although I have started one based on Petra’s 3/8 cross over. It will be interesting to see if I can keep emotion out and follow through. This one I have written down and posted on my bulliten board. In the past while I had an idea or plan at the time of purchase, it was in my head and was not always acted upon.

125

Yes I have a trading plan

199 candies

Yes I have a documented trading plan.

Starts with a search similar to but not identical to the one used for the Canadian Retirement Portfolio. I then have a checklist template that I complete for each strong potential purchase. It addresses the 14 points from Dr. D on page 96 of the Green Book. Finally I have a number of “buy” criteria that I assemble in a spreadsheet that automatically turns each criteria green or red based on (variable) criteria that I can set. I look for most or all of the criteria to be green. (This has helped me decide against some purchases that turned out to be poor candidates.)

For Market Entry I started out with the DEW and still consider that my “line in the sand” but I am also experimenting with GLB and RT Kicker as I am missing the start of some up trends.

For exit signals I set 10% trailing stops in the Genius (to get email alerts) and I also watch for VST < 1.2. I am not yet happy with my exit signals and continue to look for improvements.

My guess for no. of valentine candies is 337.

Yes I am working on improving my trading plan. I guess 234

I’ll say 750 candies. I have a written plan and I mainly use Petra’s Burlington portfolio managed with weekly 3/8. I have a Jake’s Portfolio and some selections from Retirement and Safe & Sound. Many of these overlap which I take as a good sign. For swing trades I use the daily 3/8. All but 2 stocks have VST’s greater than 1.2. All but two have Buy ratings. Two are rated Holds but are both very small holdings that I consider to be more of a casino or speculative nature. I have begun doing some simple options trades, all of which are working out so far and I plan to do more of these for income. I have a little more than 10% in US$ as a bit of a hedge against the Looney. This was in 5 stocks but I just sold 4 of them. This was more than 20% two years ago which kind of says something about not having a plan at the time.

Yes I have a trading plan.

my guess is 232 candies.

1. Yes.

2. 535 candies.

Yes I have a trading plan. In fact I have 4 different plans for diversity of my portfolio.

My guess is 402 candies.

1 . Yes

2 . My guess is 295 candies

Yes, I have a plan – However I will be “Tweaking ” it after I listened to Brian’s STOW

Candy Jar — 444.5

Yes.

210 candies.

HI Stan:

Yes Mr. Stan, I have a written trading plan.

Candy Jar 286.

Hi Stan,

Yes I have a couple of trading plans – both operating on a PW signal in conjunction with the MTI > MTI(8) on the market.

For quicker growth, I like using the 3 x 8 signal in conjunction with Rising RT, OBV, DPOs and ADX and being > 40 MA on High CI and / or High RT leveraged ETFs and Top VST stocks

For longer term, core items, I am running with Jake’s Patent Winners

I also like to monitor these plans using Support & Resistance, The Star Search and Stochastics

There 231 candies in the jar

See you soon

Cheers !

Barry

I use Petra,s 3 & 8 day EMA crossovers. There are 350 candies in the jar

Yes, 639 candies

Yes to trading plan 273 candies

Yes I have trading plans. I use Smooth & Steady; 1.2 DY High CI, and Jakes Winners. I also use Top 3 WOW Div Revised Quarterly in a small portfolio.

I maintain a Sold Portfolio for stocks sold in each quarter. This helps me to refine my Sell Criteria.

I think I’m too late for the candy count, but my guess is 228.

YEs a Trading plan – but still working on it

162 candles

Yes 309 candies

Yes I have a plan – 499 candies